Text & media

Introduction: Navigating Medicare Advantage in 2026

Choosing the right Medicare Advantage plan is a crucial decision for millions of seniors across the United States. As we approach 2026, Humana continues to be one of the most recognized and trusted names in the healthcare space. With its updated Medicare Advantage offerings for 2026, Humana aims to provide tailored solutions that combine affordability, quality care, and comprehensive features.

In this guide, we provide a detailed look into the Humana Medicare Advantage Plans for 2026, helping beneficiaries make informed decisions. From plan types and coverage updates to provider networks and cost breakdowns, this article is designed to be your go-to resource.

Overview of Humana Medicare Advantage Plans

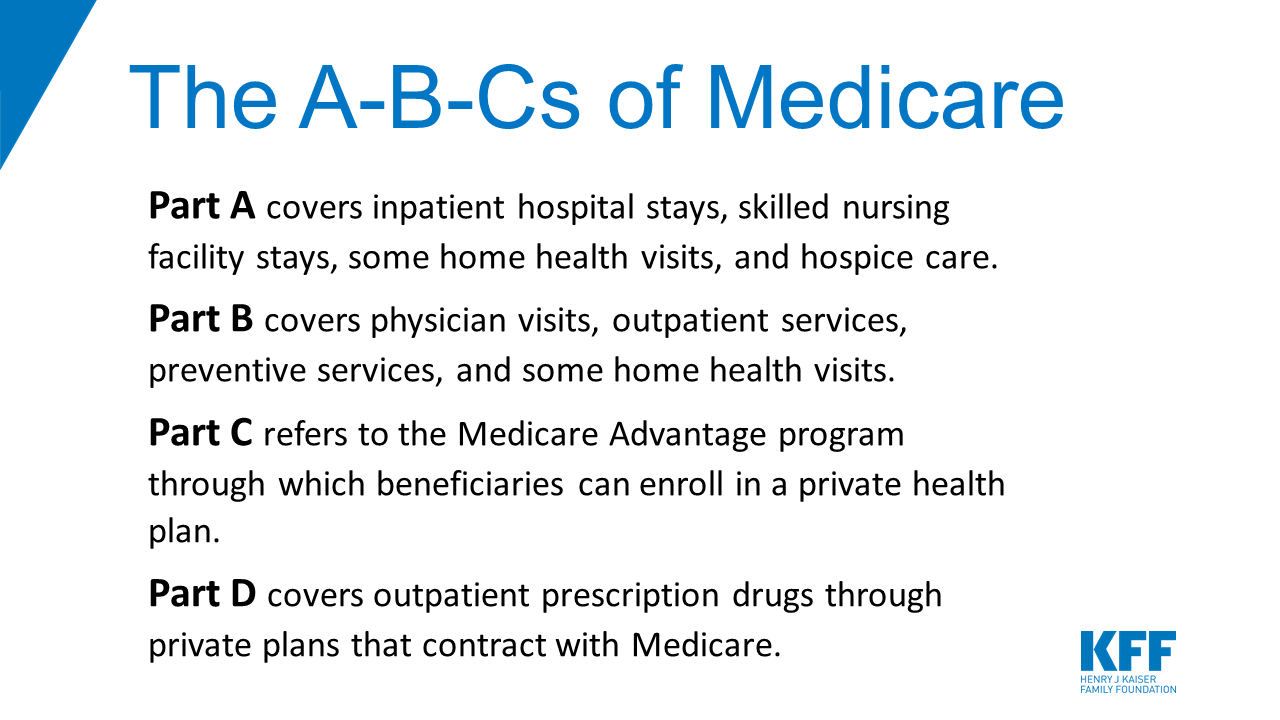

Humana’s Medicare Advantage (Part C) plans bundle Medicare Part A (hospital) and Part B (medical) services with additional benefits such as dental, vision, hearing, and wellness programs. The 2026 lineup continues to focus on flexibility and value.

Key Types of Plans Available in 2026:

Health Maintenance Organization (HMO)

Preferred Provider Organization (PPO)

Private Fee-for-Service (PFFS)

Special Needs Plans (SNPs)

Each plan type offers distinct structures, provider flexibility, and costs, making it essential to compare options side-by-side.

What’s New in 2026?

The 2026 Humana Medicare Advantage plans introduce several enhancements designed to better serve enrollees:

Expanded Telehealth Services: More specialties available for virtual visits.

Flexible Spending Cards: Increased allowances for over-the-counter products and groceries.

Enhanced Prescription Coverage: More generics at $0 copay and expanded Tier 1 formulary.

Mental Health Access: Broader in-network mental health professionals and support tools.

According to Forbes Health, digital healthcare services are expected to be a leading factor in plan selection.

Coverage and Benefits Comparison

Humana’s 2026 plans are structured to address different health and financial needs. Here’s what most plans include:

Standard Coverage

Medicare Part A and B services

Emergency and urgent care coverage

Routine vision, dental, and hearing

Worldwide emergency travel benefits

Additional Benefits

Fitness programs (SilverSneakers)

Meal delivery post-hospitalization

Prescription drug coverage (MAPD plans)

Learn more about how Medicare Advantage works from the official Medicare site.

Comparing Costs and Premiums

Plan affordability varies by state and county, but here’s a general breakdown:

Keep in mind, $0 premium plans often still require copays for services.

Service Areas and Network Access

Humana has expanded its service areas in 2026, particularly in rural and underserved counties. PPO and HMO networks continue to grow, with improved in-network access to specialists.

Coverage Expansion Highlights:

Over 90% of U.S. counties now covered

Broader networks in Florida, Texas, and California

More in-network hospitals and urgent care centers

Refer to Humana’s official service area locator for your ZIP code-specific options.

Enrollment Tips and Eligibility Criteria

Enrollment Periods:

Initial Enrollment Period (IEP)

Annual Enrollment Period (AEP): Oct 15 – Dec 7

Special Enrollment Periods (SEPs)

To enroll in a Humana Medicare Advantage Plan for 2026, individuals must:

Be enrolled in both Medicare Part A and B

Live in the plan’s service area

Not have End-Stage Renal Disease (except SNP options)

You can compare plans and enroll directly through the Medicare Plan Finder tool.

Pros and Cons of Humana Medicare Advantage 2026

Pros

Comprehensive coverage including dental and vision

Affordable $0 premium options

Large provider network

High CMS star ratings in multiple states

Cons

Network limitations for HMO plans

Prior authorizations required for many services

Coverage varies by zip code

Humana’s Ratings and Reputation

Humana continues to maintain a strong reputation in the Medicare space:

CMS Star Ratings: Many Humana plans receive 4+ star ratings.

Member Satisfaction: High scores in customer service and plan benefits (based on JD Power data).

BBB Accreditation: A+ rating from Better Business Bureau.

You can check CMS star ratings for your state here.

Final Thoughts: Is Humana Right for You in 2026?

When evaluating Medicare Advantage plans for 2026, Humana stands out for its balance of affordability, comprehensive coverage, and nationwide reach. Its innovations in virtual care, wellness benefits, and customer experience reinforce its position as a leader.

We recommend using Medicare’s official resources and speaking to a licensed agent to assess which Humana Medicare Advantage Plans for 2026 match your individual needs and preferences.